GST Search by Pan – Know Your GST Number Online

What is GSTIN?

Goods and Services Tax Identification Number (GSTIN) is a unique identification number (UIN) that is allotted to every taxpayer (Dealer, seller or any taxpayer) registered under the GST Regime, and one can easily carry out GST Search by PAN.

The 15-digit alphanumeric PAN-based code is generated to help the tax authorities maintain the GST payment and due records under a single platform to ease compliance and administration procedures. It comes under public information and can be used by anyone to check the authenticity of a business. The GSTIN replaces the multiple indirect tax numbers levied by the state and the Centre for VAT, Tax, Service Tax, etc., for a single business.

The idea of “One Nation-One Tax-One Tax Identification Number” is implemented in the form of GSTIN.

A business entity can have many GSTINs for its various branches. A separate GSTIN is required when dealing in the same business from a different state or Union territory in India. The companies already registered under the older systems, such as the Value-added Tax (VAT), have been automatically transferred to the GSTIN System and received their GST number. In contrast, those newly registered under the GST receive a new GSTIN after the completion and approval of their registration. The GSTIN Search by Name tool helps to search GST numbers by name as well.

How To Use The GST Search Tool?

One can easily find the GST NUMBER or GSTIN of a registered company just by name or personal identification number (PAN). Each state has a shared list of GSTIN and names of companies with the central government, and the list shows the division of taxpayers between state and central government and one can easily carry out GST verification Search by PAN or GST search by name.

Key Point: To Check your GST number and do GSTIN Verification through our tool easily and without any hassles just check out our GST Search Tool page.

How to Do GST Number Search by Name and Pan tool

To calculate the GST late fee accurately, follow these steps:

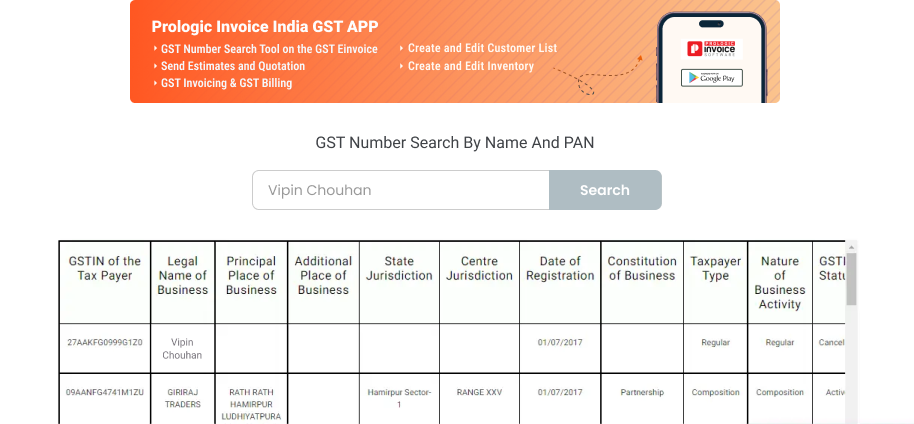

For example, if you want to do the GST number search by the name of an enterprise named GIRIRAJ TRADERS IN DELHI, then search with the name mentioned above. You will get all the registered information associated with GIRIRAJ TRADERS IN DELHI.

The question is where to search the name of a company/business in the GST no check of a registered company/business. For that, you can go to this link www.gsteinvoice.com/gst-number-search-by-name-and-pan/ On this website you can search GST number by name. After clicking the above-mentioned link you will redirect to the GST no Search by name and PAN page as shown as follows-

After following the above step you will be redirected to the next page as shown in the above image, as you can see we get the GSTIN of Vipin Chouhan TRADERS i.e. 09AANFG4741M1ZU by the GSTIN search by name and we also get all the registered information.

We can also do a GST number check of a company/business by entering its PAN number. It can be done by the GST Number search by PAN.

NOTE:- We can only do the GST no. search by PAN and name for the following taxpayers:-

What are the Benefits of Using the GST Search Number by Name

The GST Number Search by Name and GST Number Search by PAN tool helps find and verify the business entities in two ways: GSTIN search by name and PAN. The GST Number search records are open to the tax authorities and the general public, making them accessible online.

The authenticity of an entity is checked, including all the information it claims to be true. The GST number search by name and PAN helps in GST number verification to avoid associating with fake GST Numbers.

GST Number Verification

Key Point: You can quickly create and track sales orders with our Billzo - Billing E-way Bill GST App, which includes a bill builder, invoice creator, and e-way bill maker. Check it!

Importance of GST Number or GSTIN

GST Number or GSTIN is necessary as GST has replaced the previous taxation systems. Let us understand its importance as per its requirement mentioned in the Goods and Service Act (GST ACT)

Availing ITC: Input tax credit or ITC is the GST paid on the purchases of goods or the input service in the course of business. Therefore, to use the credit of input GST from GST payable on sales, it is necessary to have GSTIN to use ITC.

Filing of GST Returns: GST Returns must be filed under the GST Act, such as GSTR-1, GSTR-3, GSTR-9 and many others. To file these returns, it is essential to have GSTIN give the proper record of the goods and services supplied and received monthly, quarterly, and annually to the Government, which will further help in the availing of ITC. Before filing the returns, it is essential to verify the GST number by GST search by name and PAN.

Claiming of Refunds: Under the GST act, a refund can be claimed under various provisions such as export of services, supply to SEZ unit, etc., so, For claiming the refund under such provisions, it is vital to have GSTIN with the properGST verification.

General Requirement: Under the GST Act, GSTIN is the mandatory registration number. Therefore, it is necessary to obtain GSTIN after taking registration under the GST Act.

What Is the Format of the GST Number?

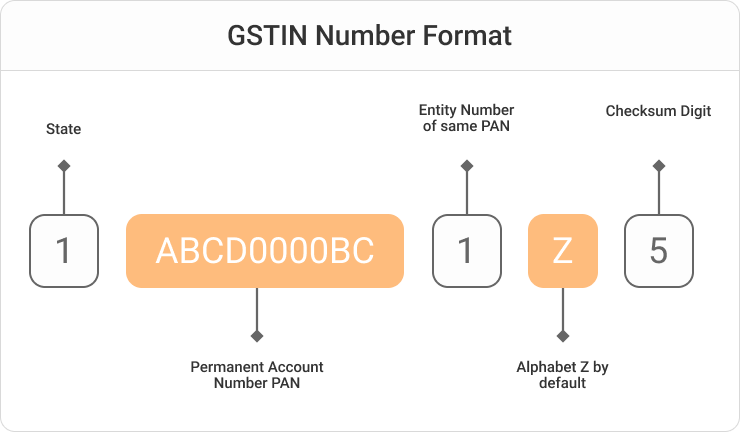

The GSTIN assigned to the registered entity follows a specific format.

For Example, In GST Number - [06KKKKK2624R8Z4]- 06 is the State code. KKKKK2624R is the PAN Number and 8, Z, 4 are the

registration number, Z digit by default and Check code respectively illustrated below.

The 15 digits are structured as follows-

Key Point: We are only a click away to answer all the GST-related questions you may have, and we are delighted to assist you with our GST Software and other products. Take a look

The First two digits of the GST number are assigned based on the state code of the business. State code digits can range from 01-35 as per the Indian consensus of 2011. For example, according to the State code list, 06 is used for Haryana, and 24 is used for Gujarat.

he digits 3 to 12 in the GST Number denote the PAN Number of the individual associated with the business registered under the GST.

This number denotes the total number of registrations done by an individual or business with the same PAN. The limit of such registrations is 35. As this is an alphanumeric code, 1-9 numbers can be used for the first nine digits and the alphabet for the rest. For example, number 1 is used for the first registration. However, for the 10th registration, it would be coded with the alphabet A.

The 14th digit is kept to be "Z" by default, commonly for all GST numbers.

The 15th digit of the GST number is the check code to detect any errors.

Frequently asked questions

Prologic Invoice software offers GST-compliant invoicing, e-way bill generation, e-invoice creation, detailed reporting, inventory management, supplier and customer management, and secure login amongother features.

With GST Suvidha Kendra you can create all categories of Billing documents like Sales Invoices, Sales Returns, Purchase Invoices, Purchase Orders, Estimates, Manage Inventory in real time with Stock In & Stock Out options, and generate Delivery Challans for Invoices directly. Barcode Scanner and Thermal Print options are also available.

With GST Suvidha Kendra you can create all categories of Billing documents like Sales Invoices, Sales Returns, Purchase Invoices, Purchase Orders, Estimates, Manage Inventory in real time with Stock In & Stock Out options, and generate Delivery Challans for Invoices directly. Barcode Scanner and Thermal Print options are also available.

With GST Suvidha Kendra you can create all categories of Billing documents like Sales Invoices, Sales Returns, Purchase Invoices, Purchase Orders, Estimates, Manage Inventory in real time with Stock In & Stock Out options, and generate Delivery Challans for Invoices directly. Barcode Scanner and Thermal Print options are also available.

With GST Suvidha Kendra you can create all categories of Billing documents like Sales Invoices, Sales Returns, Purchase Invoices, Purchase Orders, Estimates, Manage Inventory in real time with Stock In & Stock Out options, and generate Delivery Challans for Invoices directly. Barcode Scanner and Thermal Print options are also available.

With GST Suvidha Kendra you can create all categories of Billing documents like Sales Invoices, Sales Returns, Purchase Invoices, Purchase Orders, Estimates, Manage Inventory in real time with Stock In & Stock Out options, and generate Delivery Challans for Invoices directly. Barcode Scanner and Thermal Print options are also available.

With GST Suvidha Kendra you can create all categories of Billing documents like Sales Invoices, Sales Returns, Purchase Invoices, Purchase Orders, Estimates, Manage Inventory in real time with Stock In & Stock Out options, and generate Delivery Challans for Invoices directly. Barcode Scanner and Thermal Print options are also available.

With GST Suvidha Kendra you can create all categories of Billing documents like Sales Invoices, Sales Returns, Purchase Invoices, Purchase Orders, Estimates, Manage Inventory in real time with Stock In & Stock Out options, and generate Delivery Challans for Invoices directly. Barcode Scanner and Thermal Print options are also available.

With GST Suvidha Kendra you can create all categories of Billing documents like Sales Invoices, Sales Returns, Purchase Invoices, Purchase Orders, Estimates, Manage Inventory in real time with Stock In & Stock Out options, and generate Delivery Challans for Invoices directly. Barcode Scanner and Thermal Print options are also available.

With GST Suvidha Kendra you can create all categories of Billing documents like Sales Invoices, Sales Returns, Purchase Invoices, Purchase Orders, Estimates, Manage Inventory in real time with Stock In & Stock Out options, and generate Delivery Challans for Invoices directly. Barcode Scanner and Thermal Print options are also available.