GST Filing Preference

GST Filing Preferences: Choosing the Right Approach for Small Businesses

The Central Board of Indirect Taxes and Customs (CBIC) has recently launched the transformative Quarterly Return Filing and Monthly Payment of Taxes Scheme (QRMP), designed specifically to alleviate the compliance burden on small taxpayers. With an annual turnover of up to Rs. 5 crores, this forward-thinking initiative not only aims to relieve businesses of the complexities often associated with tax obligations but also seeks to enhance their overall efficiency. QRMP stands out as a significant development in the realm of tax administration, providing a structured framework that simplifies the tax filing and payment process. By shifting to a quarterly return filing schedule combined with monthly tax payments, small businesses can better manage their cash flows and streamline their financial operations. This approach not only reduces the frequency of compliance tasks but also minimizes the risk of penalties associated with late or incorrect submissions.

This comprehensive guide delves into the intricacies of the QRMP scheme, shedding light on its key features, significance, and benefits. It aims to equip businesses with the necessary knowledge to effectively navigate this new system, thereby maximizing the advantages offered by QRMP. From understanding the filing process to exploring how this initiative can lead to significant cost savings, this manual serves as an essential resource for small businesses looking to thrive in a more simplified tax environment.

Understanding QRMP: Simplifying Taxation for Small Businesses

Overview of the QRMP Scheme

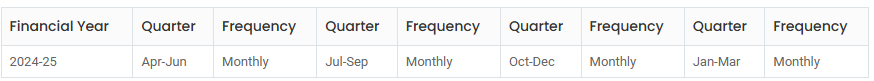

The CBIC introduced the QRMP program to simplify compliance for small taxpayers. This initiative allows businesses with an annual turnover of up to Rs. 5 crores to opt for an alternative filing schedule. Instead of the standard monthly filings, eligible taxpayers can file quarterly returns while making monthly tax payments under the QRMP scheme.

Under the QRMP program, registered dealers are required to pay taxes monthly. Taxes for the first two months of a quarter must be paid using Form GST PMT-06 by the 25th of the following month. Taxpayers have two options for making these payments during the first two months of a quarter:

- Fixed Sum Method: The GST Portal generates a pre-filled challan on Form GST PMT-06 based on the dealer's past records, calculated as 35% or 100% of the previous tax liability.

- Self-Assessment Method: The taxpayer must pay the actual tax liability based on their sales, after deducting the Input Tax Credit (ITC).

Procedures Explained

Note: When using the fixed sum method, the 35% challan can be generated by selecting "Reason for Challan" > "Monthly Payment for Quarterly Return" > "35% Challan." This will calculate the 35% challan based on the conditions outlined below:

- 35% of the tax amount paid from the Electronic Cash Ledger in the GSTR 3B return for the previous quarter, if it was provided on a quarterly basis.

- If the tax was paid on a monthly basis, 100% of the tax amount paid from the Electronic Cash Ledger in the GSTR-3B return for the last month of the previous quarter.

Eligibility Criteria for QRMP

The QRMP Scheme is available to dealers, including individuals, businesses, or entities, allowing them to pay taxes monthly and file returns quarterly. This scheme applies to registered dealers with a turnover of up to Rs 5 Crores in the previous financial year, who are required to file monthly GSTR-3B. Additionally, dealers acquiring a new GSTIN or opting out of the Composition scheme can also avail themselves of the QRMP scheme.

Key Point: Check out our tool page to find out how to check your GST number and complete GSTIN verification quickly and efficiently. Check it!

How Prologic Invoice Filing Preference Tool Works: A Step-by-Step Guide

1. Step: On the 'GST Filing Preference' tool page, enter the GSTIN in the search bar and click on 'Search'.

2. Step: There is no second step! Your results will be displayed instantly, fetched within seconds.

QRMP: Key Features and Advantages

1. Reduced Compliance Burden

QRMP is a game-changer for small businesses, significantly reducing the burden of monthly filing compliance. By offering the flexibility of quarterly returns, it enables businesses to optimize their resources and focus on their core operations rather than managing multiple tax filings.

2. Return Filing Flexibility

The QRMP Scheme can be selected at any time during the year for any quarter. Registered individuals can opt in between the first day of the second month of the previous quarter and the last day of the first month of the current quarter.

3. Streamlined Tax Payment

QRMP ensures consistent and predictable monthly tax payments, providing businesses with a reliable structure. This promotes financial stability and supports effective cash flow management.

1. There is no tax liability.2. Balance in Electronic cash ledger/credit ledger is sufficient.

4. Application of Interest:

1. Fixed Sum Method: Taxpayers who meet the payment deadlines for the first two months of the quarter avoid any interest charges. However, if payments are delayed, interest will accrue at the applicable rates from the due date until the payment is made.

2. Self-Assessment Tax Method: Interest is charged on any unpaid or delayed taxes (after accounting for Input Tax Credit) that remain overdue past the specified deadline.