Search E-Invoice Status

E-Invoice Status of GSTIN

Starting October 1, 2020, taxpayers with an annual aggregate turnover exceeding INR 500 crores (at the PAN level) in any financial year since 2017-18 were mandated to adopt the e-Invoicing system under GST. This requirement marked a significant shift toward digital compliance, enhancing transparency and efficiency in invoicing processes. The e-Invoicing mechanism was introduced to streamline reporting, reduce errors, and enable the seamless transfer of data to the GST system, benefiting both taxpayers and regulatory bodies.

In the second phase of implementation, the e-Invoicing requirement was extended to taxpayers with a turnover of more than INR 100 crores, effective from January 1, 2021. This phased rollout allowed businesses to adjust to the new system gradually, ensuring better compliance and a smoother transition to digital invoicing. The ongoing expansion of e-Invoicing requirements aims to create a more structured and efficient GST ecosystem, ultimately helping to curb tax evasion and foster greater accuracy in tax reporting across various business sectors.

Key Point:The GST calculator is a tool that helps accurately calculate the GST amount on various goods or services. Use it to calculate GST on goods and services online. Check it!

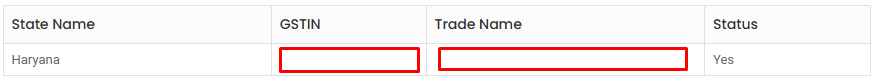

You can check the e-Invoicing applicability for a GSTIN using our free 'E-Invoice Status of GSTIN' tool.

Taxpayers can use this free tool to:

How to Use the 'E-Invoice Status of GSTIN' Tool by Prologic Invoice

1. Step: On the 'E-Invoice Status of GSTIN' tool page, enter the GSTIN in the search bar and click on 'Search'.

2. Step: There is no second step! Your results will be displayed instantly, fetched within seconds.