GST Details Check Tool - Find GST Information Online

The GST Search tool is a free service provided by Prologic Invoice's GST verification search. With a single click, you can search for GSTIN details and perform GSTIN verification using the Prologic Invoice GST Finder tool.

Key Point: In order to search the GST number by your name or even with your PAN number ensure that you find your GST number easily. Explore our page

The GST Search by Number check helps verify the authenticity of a registered taxpayer. Using the GSTIN search tool on the Prologic Invoice website, you can easily identify fake or invalid GST numbers. By performing a GST status check or verification, you can ensure you're claiming the correct input tax credit, as incorrect GST numbers cannot be authenticated. Prologic Invoice's free-to-use GSTIN search tool makes GST online verification quick and simple. A proper GST number check ensures the authenticity of taxpayers, helping to confirm that tax collected flows through the GST supply chain, avoiding tax cascading.

What Is the GST Identification Number (GSTIN)?

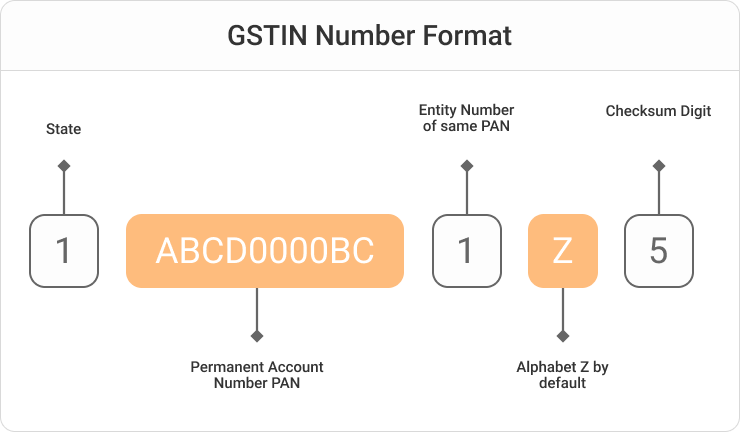

GSTIN (Goods and Services Tax Identification Number) is a unique 15-digit alphanumeric code based on PAN, assigned to every registered taxpayer under the Goods and Services Tax (GST) system. This GST number, provided along with the GST registration certificate, allows for the tracking of GST-registered taxpayers. The GSTIN Search Check feature enables you to search for GST numbers in India, making it easier to verify GST registration using the HSN code.

GST Certificate

The GST Registration Certificate is an official document issued by the GST authorities containing the GST Identification Number (GSTIN) and important business details. It includes the registered business address, both principal and secondary locations, and other relevant information, such as the type of taxes the business is liable to pay. This certificate serves as proof of a business's registration under the Goods and Services Tax Act and is necessary for compliance with GST regulations.

Why Is It Necessary to Verify GSTIN or GST Number?

The GST Number, or Goods and Services Tax Identification Number (GSTIN), is crucial for verifying the authenticity of a taxpayer registered under GST. In many instances, individuals may manipulate GST numbers (GSTIN) to avoid taxes. Using the GST Number Search tool on Prologic Invoice can provide transparency regarding business information, ensuring that you file accurate GST returns for the relevant tax period. Additionally, the GSTIN search helps you safeguard your rights to claim Input Tax Credit (ITC), which could be at risk if the GST number is fake or incorrect.

The GST Number Check feature, or GSTIN verification, is essential to ensure that Goods and Services Tax (GST) is properly collected and reaches the correct authorities. It also offers an opportunity to contribute to nation-building by supporting a transparent and efficient tax system.

How to Check GST Number?

GST number search in India is commonly used for verifying GST details. People typically rely on a free GST Number Search Tool or visit the official GST portal for this purpose.

What Are the Features of the Prologic Invoice GSTIN Search Tool / GSTIN Validator?

The Prologic Invoice GST Number Search Tool allows businesses to easily verify GST details through a single-click GSTIN search. This feature is available for free on our website, and all you need is the required GSTIN to perform the search.

Features of Prologic Invoice GST No Search Tool.

GSTIN Authenticity

There may be instances where a supplier could attempt to deceive customers by misusing a GSTIN. It is crucial to verify the authenticity and validity of the GSTIN provided by the supplier. The GST Verification tool and GST Calculator at Prologic Invoice offer a comprehensive solution to meet all your verification needs.

Verify GST Number Online Instantly

The GST Search Tool is a way to do GST registration check 100% online tool that helps in GST number verification and is just a click away on your smartphone.

The ways to verify GSTIN online are:

The GST Portal

What Is the Format of the GST Number?

It has been observed that some tax evaders have devised new methods to avoid taxes, deceiving both consumers and the government. They often use a fake alphanumeric code under the GSTIN heading to mislead consumers, making it appear similar to a legitimate GSTIN. Understanding the correct structure of a GSTIN is crucial in identifying such fraudulent practices.

Now let us understand what reveals a 15-character GSTIN or GST Number:

Understanding the structure of the GSTIN can help you verify its authenticity, especially if you're unsure while making payments at your local merchant's store. Using an online GST verification tool will allow you to check the validity of the GST number easily.

Where and How to Complain About Fake GSTIN?

If you come across any discrepancies while checking a GSTIN, it's important to know that you have the option to report it and act as a whistleblower.

You can search GST numbers on the portal and report any irregularities by emailing the authorities at [email protected]. You can also reach them by calling +91 124 4688999 or +91 120 4888999 for further assistance.

When making payment for an invoice, consumers should verify that the GST number listed on the invoice is valid by checking it on https://www.gst.gov.in/. This ensures that their payment for the Goods and Services Tax (GST) is directed to the correct authorities.

What Are the Main Benefits of Using an Online GST Number Checker or GSTIN Validator?

Here are some benefits of using an online GSTIN search and verification tool or GSTIN validator:

Conclusion

The Prologic Invoice GST check online tool allows taxpayers to verify their GST return status without the need to log in or visit the official GST verification site. With the Prologic Invoice GST Search tool, taxpayers can easily track their GST status in real time. This convenient tool simplifies the process of monitoring GST compliance, ensuring that taxpayers remain up-to-date with their filings and avoid potential penalties. By using this tool, businesses can maintain transparency and accuracy in their tax reporting.

Frequently asked questions

Yes, the company address can be found through the GSTIN. Simply enter the GSTIN of the registered taxpayer into the Prologic Invoice search tool. Click on the "Free GST Number Search Tool - Verify GSTIN Online" option to view the address details.

You can visit the official GST portal at https://www.gst.gov.in/. From there, navigate to the "SEARCH TAXPAYERS" section and click on the "Search by GSTIN" tab. Enter the GST number, and you will be able to view the relevant information.

Go to the GST portal and check with the GST number and you'll get the details.

To check if a particular GSTIN is active or inactive, simply click on the Free GST Number Search Tool and verify the GSTIN online.

This tool also allows you to check additional details such as the business name, location, state and local center, registration date, business constitution, taxpayer type, and cancellation date.

By searching for a GSTIN number, you can access details such as the taxpayer's GSTIN, legal business name, principal and additional places of business, state and center jurisdiction, and the date of registration.

The GST portal offers an option to find the owner's name using the GST number. Simply visit the GST web portal and follow the outlined steps.

To search for GST or GSTIN numbers using a PAN, click on "GSTIN Search and Verification by PAN." Enter the business's PAN number and click "Search." Note that this method follows a trial-and-error approach, so for more accurate results, it is advisable to search directly using the GSTIN.

To search for GST or GSTIN numbers using a Name, click on "GSTIN Search and Verification by Name." Enter the business's legal Name and click "Search." Note that this method follows a trial-and-error approach, so for more accurate results, it is advisable to search directly using the GSTIN.

Quick Links

- What Is the GST Identification Number (GSTIN)?

- GST Certificate

- Why Is It Necessary to Verify GSTIN

- How to Check GST Number?

- What Are the Features of the Prologic Invoice GSTIN Search Tool

- GSTIN Authenticity

- Verify GST Number Online Instantly

- The GST Portal

- What is the Format of GST Number?

- Where and How to Complain About Fake GSTIN?

- What Are the Main Benefits of Using an Online GST Number Checker?

- Conclusion

- Verify GST Number Online Instantly

- Frequently asked questions